Heidrick & Struggles advises ESG achievements and targets

Crises are arising frequently, but environmental, social and governance concerns will remain for the foreseeable future. Organisations are navigating more and more difficult challenges as these events occur, which is putting significant pressure on their sustainability strategies.

Claire Skinner, Regional Managing Partner, Europe at Heidrick & Struggle and has worked in the fields of sustainability, energy and environmental infrastructure for over 20 years. She has advised global corporations, investment funds and philanthropic groups on decarbonisation, asset optimisation, sustainability and climate change, as well as building business across renewable energy and clean technology. Claire provided her thoughts on the sustainability journey so far, the areas in which organisations must focus in terms of ESG, and the current crises that affect the globe.

How far has sustainability come over the last 30 years?

When I started in sustainability search, it was five years after the 1990 Environmental Protection Act, and there was a strong focus on environmental disclosure and assurance. So I cut my team recruiting heads of EHS principally in the natural resources sectors, or Senior Environmental Assurance professionals for the major Audit firms, Partners for the growing number of Environmental Consultancies. There was a heavy focus on ISO standards, which then progressed to a focus on understanding social impacts as thinking evolved. I was also heavily involved in the growing Socially Responsible Investment Fund growth, recruiting fund managers for dedicated ESG funds; principally at that time inequities.

The world of sustainability and the roles within it have shifted completely since then. In corporate sustainability roles, there has been a fundamental shift from small “e” being tacked onto Health Safety to enterprise-wide Chief Sustainability Officer roles which are core to strategic transformation, working closely with the CEO and C-Suite with much greater exposure to the Board.

The focus, time and commitment of the Board on sustainability has accelerated hugely and conversations are no longer about compliance but fundamentally about business transformation, with a strong focus on investor relations. The reputational risk continues to be important, but these roles are so much more than that – a cohesive transparent sustainability strategy is now absolutely central to a CEO's ability to raise capital and attract investors, whether public or private – that for me has been the game-changer.

What are the big sustainability events that have shifted business mindsets?

Too many to mention, but clearly, the COPs have been huge. The Kyoto Protocol adopted in 1997 as I was starting out was a major one for me – which committed largely industrialised economies to limit and reduce greenhouse gases (GHG) emissions in accordance with agreed individual targets. There were setbacks along the way, and those of us in the industry wanted it to go so much faster, and then we had the Paris Agreement in 2015 – which for me was when the world, governments, global business leaders and critically growing numbers of global financial institutions really engaged and committed to making the change to less than two-degree temperature rise. Paris was the culmination of the most incredible hard work by so many people – for me, there were too many moments which really stand out: when the Pope lit up the Vatican and urged political leaders to step up, and Ban Ki-Moon’s emotional speech.

But beyond the COPs, storm after storm, droughts, crop failures and the heart-breaking migration of people who are displaced by environmental impacts have raised awareness. The media have also played a huge role, whether it be Al Gore’s Inconvenient Truth in 2006, or the incredible Blue Planet series with David Attenborough – which informed people about the threats of industrial and plastics pollution in our oceans, the loss of mangroves and coral reefs...it has led to the wider public including business leaders becoming aware more generally. And then of course there is Greta… at Davos. But in the wider world, business leaders for over a decade have become increasingly aware of both the risks and opportunities of embracing sustainability.

The momentum is building and building, the consistency of the science, climate change being central to winning votes in many countries, means things are finally moving – but we have continued to have so many setbacks and no question Glasgow was a disappointment. The interesting thing to see now will be how the world pivots as a result of Russia's invasion of Ukraine – which is heartbreaking on every level. But will high energy prices and heightened geopolitical risk accelerate investments in renewables and energy efficiency technologies? – I truly hope so.

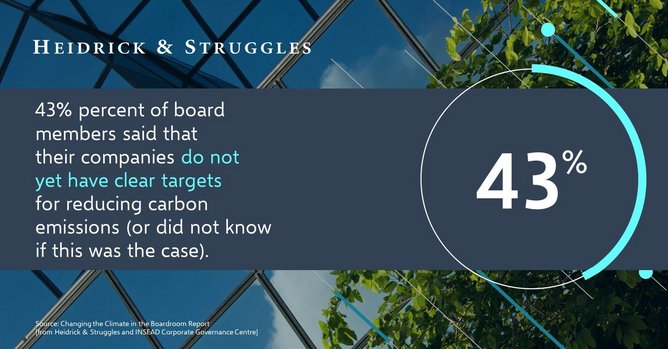

Another critical shift for me is the role of the board. They are much more engaged on this topic from the chair down. We regularly host board events on climate and we are finding that the chairman can be even more passionate and engaged than some Chief Sustainability Officers! Chairs recognise the complexity of climate and sustainability issues and the best of them are proactively steering companies through this journey. I think there is an element of legacy at play here – chairs want to do the right thing and want to be on the right side of history.

Are there any industries that we need to see more input from, in terms of ESG?

I don't think anyone's cracked it but there are certainly some industries that are later to the table than others. The great news is that capital is focusing on decarbonisation and we are seeing a number of funds being raised to specifically focus on those difficult-to-decarbonise industries; whether that be shipping, cement, steel, airlines or agriculture. Capital is flowing to support net-zero, and also a growing focus on nature-based solutions, plastics reductions and habitat protection.

We are seeing huge interest in the decarbonisation of transport, whether that is EV or hydrogen infrastructure globally. And with Ukraine, there is a heightened awareness of the decarbonisation of heat, so I anticipate lots happening there. Across all businesses, it is no longer OK not to have a robust sustainability strategy, companies are compelled to act and there is a huge amount to do for everyone to meet their net-zero commitments.

How are CSOs and other C-suite and board members responsible?

Sustainability is not the responsibility of the CSO; it is the responsibility of the Board and the entire CEO and executive team. How that plays out in roles and responsibilities has been very interesting and we are seeing a huge demand for sustainability leadership in functional roles, in Board roles, but also a wider appreciation of sustainability in all aspects of the c-suite – whether that is the CFO, Chief Marketing Officer, Chief Innovation Officer, CHRO etc.

We have embedded sustainability considerations into leadership assessments, team assessments and Board reviews. Accountability is shared and each function has a role to play.

How the profile of the Chief Sustainability Officer has evolved is interesting, but it is important to recognise that there is no such thing as one size fits all on CSOs. It really depends on the industry, its impact and its supply chain; in the searches that we are doing, we are seeing a huge variety of skills and competencies that businesses are seeing. We have requests for leaders who are very externally focused, with a strong climate policy expertise, sometimes combined with strong corporate and government affairs or investor relations.

Then there are those CSOs who are much more supply chain orientated, particularly in fast-moving consumer goods (FMCG) companies we are perhaps the most advanced in tackling scope 3 emissions. And then we see manufacturing and operational oriented roles where leaders are focused on energy, water and waste optimisation, innovation and Industry 4.0

Whatever the profile, chief sustainability officers are increasingly engaging with CEOs and have the opportunity to work with peers in the C-suite. We are increasingly seeing them report to the CEO, but if not certainly be part of the C-Suite, with significant exposure to all of the director reports of the CEO. Again the CSO is spending much more time with the Board, both in the meetings, but also working with the Board Committee Chairs which is great to see.

I think the connection between sustainability and purpose has just been strengthened in multiple facets. And I think COVID has caused people to pause, to reflect, to look at inequity, to look at equality. The tragic death of George Floyd, for example, has also had a huge impact on DE&I focus which has strong links to sustainability too. I think sometimes people focus too much on the 'E' of ESG, and perhaps we don't spend as much on the 'S' in terms of the social and human rights aspects of operations, and of course the governance of them.

Do you think COVID-19 accelerated or decelerated ESG action?

I think both. In the early stages, leaders focused on keeping people safe, shoring up businesses and supply chains, so longer-term sustainability issues dropped down the agenda no question. However this then shifted to the “build back better” and with fiscal stimulus, there was increased momentum on green infrastructure, nature-based solutions, biodiversity and decarbonisation. There are a lot of people who would argue that we weren't aggressive enough on that, that we should have deployed more capital into green solutions.

On the social side, COVID was huge. It started with immediate health and safety considerations and then accelerated investment and thinking around mental health and DE&I. Leaders had to show up differently, and I think empathy, inclusion and purpose came to the fore. Those leaders that stepped up, saw the benefits, and those who didn't, lost the loyalty of their teams.

What effects do you think the Ukraine crisis will have on renewable energy adoption?

Well, it'll be interesting to see how sentiment changes around onshore renewables in terms of people's acceptance of renewables in developed countries. In emerging economies, that don’t have indigenous energy resources, I think the economics for investment in renewables will be even more compelling. But I do think there will be huge investments in all types of energy infrastructure as resilience and energy security become increasingly important.

- How Tenaris & Tata Steel are Sustainability Champions AgainSustainability

- Colgate-Palmolive Earns 14th Successive Sustainability AwardSustainability

- Top 10: Women in Sustainability in the UK and EuropeSustainability

- E.ON Next: Customer-Centric Approach Drives Business SuccessSustainability