Middlemarch: How waste became a case for ESG investing

S. Grutman, D. Tanzer, and M. Rossi

In a society grappling with environmental challenges, social tensions, and questions of inequality, it is no surprise ESG investing has become a topic of interest. ESG investing deploys capital in companies that address these issues while generating acceptable returns for the capital providers that fund them.

Many institutional investors seeking ESG exposure have accepted lower returns from their ESG investments, but merchant bank Middlemarch Partners takes a different approach toward ESG. It seeks to “do well economically” as a precursor to “doing good for the environment and society at large.”

Contrary to the conventional thinking that assumes ESG companies cannot generate high investor returns because environmentalism is a drag on profits, Middlemarch believes its growth-stage ESG merchant banking clients need to generate 25-50% IRRs for the private equity firms that invest in them. Middlemarch believes the best way to advance ESG goals is to focus on businesses that can deliver strong returns with no “greenium” return discount for achieving environmental or social goals. As investors prove that one can make money and improve society at the same time, it will help build momentum for ESG investing.

Middlemarch recently served as the exclusive investment banking advisor to help create Veransa, a company which takes leaves and grasses and converts them into high-quality, organic compost and transforms tree waste into bio-fuel wood pellets. Middlemarch partnered with the management team that conceived of the idea of a garden waste recycling company, sourced the lead investor, and co-invested in the company. Veransa compost is sold to farmers and consumers so they can replace chemical fertilisers with an organic product that enriches their soil. And the wood pellets are sold to energy production companies which use the pellets as an alternative fuel source to coal.

Middlemarch believes Veransa can capture superior economics, generate 30%+ annualised rates of return for its investors, and at the same time improve the environment, support organic farming, and sequester carbon from the atmosphere.

The US garden waste industry Today

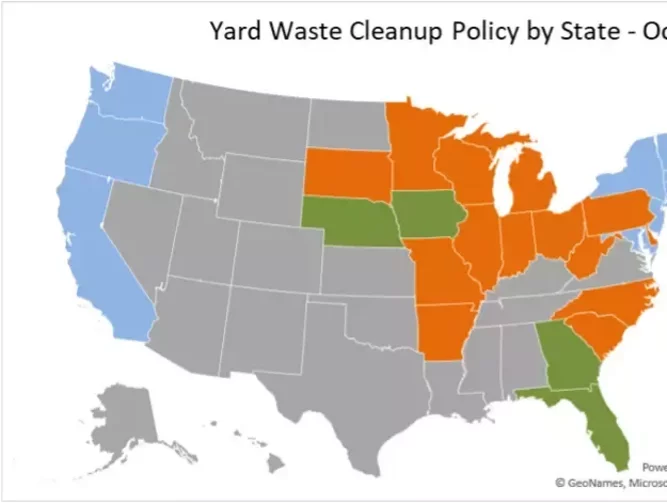

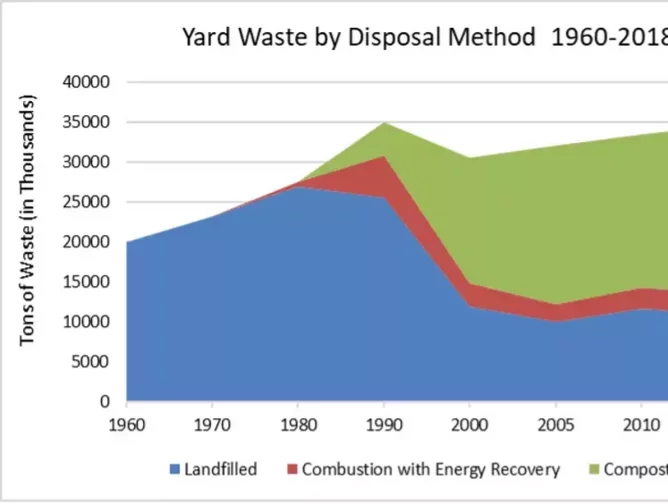

The Garden Waste Industry in the United States is highly fragmented and shaped largely by state-level regulations that define how garden waste must be handled. Currently, 20 states enforce mandatory disposal of garden waste at dedicated collections disposal sites, and an additional 9 states require garden waste recycling, meaning that the waste cannot be landfilled.

Most garden waste operators are “mom and pop” small businesses that lack the capital to make major investments in highly efficient waste processing equipment. Garden waste collections businesses have historically provided garden waste intake (at company-owned collection centres) for municipal and commercial clients. They generally perform this service for a “tipping fee”. These clients are generally landscapers, garden maintenance companies, and tree maintenance companies. After separating clean wood waste for sale to decorative mulch companies, garden waste is grinded into feedstock and transported to local farms – at the expense of the collections company – or sold at low prices to companies for further processing. In many states, 90 percent of garden waste feedstock goes to local farms and ranches for use as low-value, rudimentary topsoil that decomposes naturally over 18 to 24 months.

Vertical integration and tech transforming the industry

Middlemarch and its client Veransa identified a significant market inefficiency in the garden waste collections market that could be exploited for economic advantage. By combining the collections business with a compost manufacturing business, an integrated garden waste company could earn more revenue, lower its overall operating costs because the two businesses leveraged each other’s capabilities, and transform a waste disposal business into a recycling business.

The opportunity for vertical integration and composting technology investment supports the vision for a higher volume “professional garden waste company.” To create it, Veransa is spending millions of Dollars upgrading its garden waste processing and compost manufacturing infrastructure, with a focus on electrification to reduce costs and generate a superior environmental profile. The consequence of this investment is a business with significant cost synergies and two revenue streams from garden waste collections and compost sales. The environmental impact of this combined business model is also markedly improved, as farmers can immediately lay down organic compost to improve soil remediation, enable carbon sequestration, and decrease (or eliminate) chemical fertiliser use.

These environmental benefits are especially important in states like Florida, where coarse soil contains large amounts of sand and clay, contributing to decreased moisture retention and nitrogen fertiliser runoff. With sandy soil in need of remediation, positive regulatory pressures on garden waste collections, and economic incentives in higher margins for farmers that grow organic crops, Florida is one example of a geography where a combined “waste-to-compost” business is built to succeed.

Public companies in the sector pursue other ESG angles

Veransa is focused on addressing the unmet need for organic compost by processing garden waste in an innovative way. A public company is using garden and wood waste to address the need for alternatives to coal as an energy source.

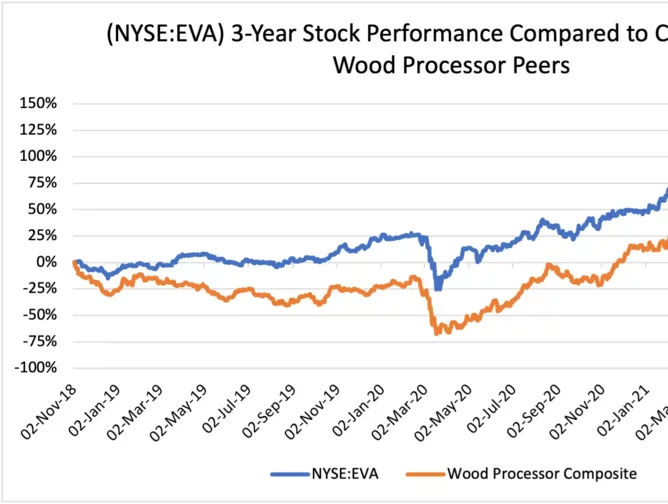

Enviva Partners, the largest global producer of wood pellets that are used as an alternative biofuel to coal and natural gas energy, has grown rapidly as energy producers have sought cleaner feedstock sources. Enviva sources wood from commercial and private landowners and often uses wood fibre from the logging process, which has no other market value, as material inputs. Enviva converts the wood residue into pellets across its ten US plants and exports these wood pellets to the company’s primary end markets of Europe and Asia, where many municipal coal power plants have been redesigned to burn wood pellets.

In response to heightened demand for coal alternatives, Enviva has expanded plant construction and B2B contract growth, propelling Enviva’s stock price more than 50% in 2021. Compared to competing publicly traded wood processing companies, Enviva has seen significantly higher revenue growth over the past three years and has focused more heavily on plant and equipment investment to scale growth, positively impacting the company’s stock. The company has also experienced significant multiple expansion relative to comparable companies over the past year. Enviva shares have increased by 30% annually on average over the past five years.

Takeaways about ESG Opportunities in Garden Waste Recycling

Middlemarch has identified a number of insights from its experience facilitating a private market buyout in an ESG sector and from its review of the public investment opportunities in garden waste-related ESG companies.

Many ESG-focused investment firms are recently formed and are only beginning to accelerate their investment pace. Middlemarch identified 29 large ESG-focused private equity funds active over the last fifteen years, with an average fund size of US$979 Million. Of this fund group, more than half finished raising capital in 2018 or later. Additionally, of those recently closed funds, the majority have only started investing within the last twelve to eighteen months. It appears that investment pace is only beginning to pick up and investors are being quite selective about what ESG projects they will finance.

Most ESG businesses are complicated and require detailed understanding of regulation, technology, and evolving market demand. Garden waste recycling is not fundamentally a complicated business, but it involves state regulations about how garden waste is handled, awareness of environmental impacts from processing garden waste, an understanding of logistics and capital equipment financing and management, and an appreciation of the marketing associated with helping farmers and consumers to embrace organic compost as a substitute for chemical fertiliser.

Making ESG investments requires disciplined focus on identifying businesses with strong profit potential. Many investors express interest and curiosity about ESG investing, but businesses with lower returns are a turn off for many economically focused investors. Middlemarch has found that grounding the investment case in above-market returns rather than focusing mostly on the environmental benefits as well as developing a deep understanding of the value drivers of an ESG business made for a more attractive investment candidate for a larger universe of potential investors.

Middlemarch seeks additional ESG opportunities that produce strong economic returns and address environmental and social issues in productive ways. The firm has learned how to marshal both the economic strategy and the ESG story in a way that appeals to investors seeking exposure to ESG investment opportunities. The firm believes that the best method of advancing ESG investing is through focusing on businesses that can generate strong returns quickly and demonstrate that ESG can help investors achieve their economic objectives. Ultimately, Middlemarch believes that expanding the universe of investors able to make ESG investments and providing ESG entrepreneurs the growth capital to support innovation and to create high returns businesses are the best ways to create a truly virtuous cycle that results in sustainable environmental impact.

Middlemarch Partners is a US-based merchant bank. The views expressed here do not necessarily reflect those of BizClik Media.

• Join global business leaders and sustainability experts taking meaningful action at Sustainability LIVE, held at Tobacco Dock, London, 23-24 February 2022. Register to attend today! Click here to learn more.