How did BBVA Become Europe’s Most Sustainable Bank?

There is nothing wrong with a bit of healthy competition, especially when it inspires and drives companies to be more sustainable.

Companies like BBVA (Banco Bilbao Vizcaya Argentaria), the global financial services group with a leadership position in Spain, that’s just been named Europe’s most sustainable bank for the fourth consecutive year in the 2023 Dow Jones Sustainability Index (DJSI), and the second highest worldwide.

Founded in 1857 and present in more than 25 countries, BBVA has revenues of €24.89 billion.

While being the most sustainable in Europe is clearly a considerable achievement, BBVA may be disappointed with ‘only’ getting second globally.

That’s because the Madrid-headquartered bank did achieve that premier position in 2022, but only after a recount called by the bank itself. Who knew the banking industry could be so blockbuster?

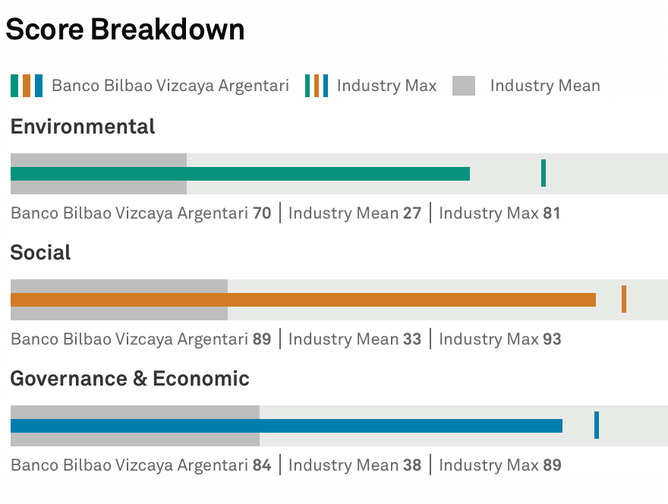

In the 2021 DJSI, both BBVA and South Korea’s KB Financial Group were tied for top global spot in the banking category. BBVA had scored 88 points but that was increased to 89 after rating agency S&P Global re-evaluated the fiscal strategy section.

While suggesting this is a Hollywood hit in the making is a stretch, the fact that companies like BBVA care so much about their score just underlines how important rankings like the DJSI are when it comes to recognising the efforts that go into sustainability initiatives.

“To be recognised as the most sustainable bank in Europe for four years in a row by the leading global sustainability index is a milestone for us,” said Javier Rodríguez Soler, Global Head of Sustainability and Corporate & Investment Banking (CIB) at BBVA.

“At BBVA, our aim is to support our clients in their transition to sustainability, while encouraging inclusive growth in our host societies. We have a key role to play as intermediaries on this journey toward a green and just transition. We are not the central players, but our role is still decisive in supporting the entire economy in its decarbonisation.”

Even being included in the DJSI is an achievement, with more than 13,000 companies this year invited to take part in the S&P Global Corporate Sustainability Assessment – a questionnaire of more than 100 environmental, social and governance issues. Only the top 10% of companies in each sector then qualify for the DJSI.

This year, BBVA scored 84 points out of a possible 100, including perfect scores for transparency and reporting, tax strategy, human rights, and customer relations. That put the bank only marginally behind Taiwan’s E.SUN Financial Holding Company on 85 points.

BBVA – carbon neutrality by 2050

BBVA is clearly committed to sustainability, which it sees as one of its six priorities to address three major challenges – fighting climate change, preserving natural capital, and driving inclusive growth.

One of the 43 founding members of the Net-Zero Banking Alliance, in 2021, BBVA elevated sustainability to the highest executive level of the organisation, creating the global Sustainability area – led by Javier Rodríguez Soler.

So what action is it taking that makes it score so highly on the DJSI?

BBVA has been carbon neutral in its own operations since 2020 and has set a 2030 goal to have all energy coming from renewables.

Having set a sustainable finance target of EU100 billion by 2025 back in 2018, BBVA has since tripled that target to €300 billion – a figure that places BBVA as one of the leading banks in this area.

By September 2023, it had achieved EU185 billion (62%) of that revised target, which it is using to finance sustainable infrastructure, agribusiness, entrepreneurship and financial inclusion.

In the word of BBVA Chair Carlos Torres Vila: "The future of the bank rests in financing the future."

BBVA is taking steps toward carbon neutrality by 2050 in its own emissions but also in those of its clients.

To achieve this, BBVA developed One View, a pioneering tool that uses data analytics to calculate companies' carbon footprint – becoming the world's first bank to use data analytics to do this. And since the end of 2021, it became the first bank in Spain to offer this calculation to its private customers.

BBVA has further stated it will stop financing coal-driven companies by 2030 in developed countries and 2040 worldwide. It is also decarbonising its portfolio by setting targets for carbon-intensive industries such as cement, oil and gas, and power generation.

“Sustainability is a competitive advantage for BBVA that makes it possible to capture incremental business, improve sustainable risk management and selectively boost growth while converting the portfolio to zero emissions,” said BBVA in a recent update on its sustainability strategy.

In the oil and gas sector, BBVA’s commitment is to reduce the emissions of its credit portfolio in exploration, drilling and extraction by 30% between December 2021 and December 2030. The bank has stated that it will not directly finance new projects related to exploration, drilling or extraction in the industry.

In power generation, BBVA has reduced emissions intensity by 4% by supporting clients that invest in renewables, and reducing new funding for coal.

There is also a focus on electric and hybrid vehicle manufacturers in the automotive sector.

BBVA’s goal is to reduce the carbon intensity of its portfolio by 46% by 2030.

There have also been reductions in the steel sector and cement.

Community central to BBVA sustainability strategy

Community is also central to BBVA’s strategy as it looks to help groups that are vulnerable, suffer inequality, or lack protection. The 2025 Community Commitment addresses four areas:

- reducing inequality and promoting entrepreneurship

- creating opportunities for everyone through education

- supporting research and culture

- encouraging volunteering among employees

To achieve these, the bank will invest EU550 million in social initiatives to support inclusive growth. BBVA will also support five million entrepreneurs, help three million with education, and train one million in financial literacy. The BBVA Microfinance Foundation will provide EU7 billion in microloans, expected to reach 100 million people.

With innovation and action, BBVA is pushing for greater recognition in next year’s DJSI, while helping millions of people in the process.

BBVA Headquarters – statement of sustainability

In keeping with its sustainability credentials, BBVA is greening all its corporate buildings, leveraging AI and green algorithms to achieve the highest building certifications.

A total of 89 buildings and 1,034 branches now have the ISO 14001 Standard, while 16 BBVA buildings and 10 offices have secured the prestigious LEED certification, with four receiving the highest Platinum rating.

Among these, BBVA's corporate headquarters in Madrid, which has been built according to the strictest sustainability criteria – using recycled materials, featuring green areas and a system that makes use of rainwater. In addition, 50,000 sensors were installed to collect data about the status of the facilities.

Home to 6,000 employees, the Madrid complex uses energy and facility management software based on artificial Intelligence (AI) to improve energy efficiency.

Thanks to the smart systems, BBVA HQ Madrid currently consumes between 15% and 25% less per year than when it was inaugurated in 2015, avoiding 1,800 tons of CO2 emissions per year. Potable water consumption ha also been cut by half and 100% of waste is recycled.

The bank also recently announced plans to relocate its NYC HQ to Two Manhattan West, a 58-story sustainable skycraper in Hudson Yards. With a LEED-Gold certification, the building sources all its electricity from renewable energy, specifically from run-of-river hydropower facilities.