Why should businesses use SASB to assess ESG performance?

Asset management firms are becoming more reliant on environmental, social and governance (ESG) data to drive their investments—as we heard at Sustainability LIVE from Philip Vernardis, Vice President & Global Lead of Asset Stewardship Reporting at State Street Global Advisors. One of the key points we heard during a discussion about ESG and reporting was about the SASB framework, and to get the most out of the information provided at Sustainability LIVE, it’s important to understand what this means.

ESG information is now on par with financial data in the eyes of investors. If a business is unable to provide data to support its efforts to become more sustainable, this could be seen as a red flag to investors—or remove its proposal altogether.

Bridging a gap in ESG communication

While businesses are very aware of ESG and its importance in both how the company is perceived by consumers and its performance in the eyes of investors, there are many that still remain in the dark when looking to measure and report data. SASB was devised by the Value Reporting Foundation—tested in the industry in 2012—to provide organisations with valuable tools to highlight their well-deserved sustainability credentials.

The SASB measurement tools and reporting methods were devised to be incorporated in forms from governing bodies for ease, including the US Securities and Exchange Commission’s Form 10-K—an annual report that provides a comprehensive summary of financial information.

To create a comprehensive framework for use across all industries, SASB has been developed in accordance with industry needs and was devised from 79 industry-based standards.

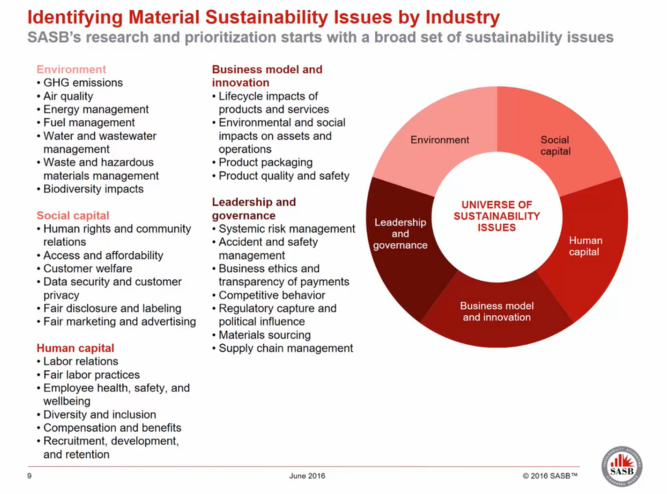

The group achieved this by carrying out industry research on all of these sectors and following up with targeted insights from operators within them. The research covered a broad range of metrics, including those involving the environment, business innovation, social metrics, leadership, and human capital.

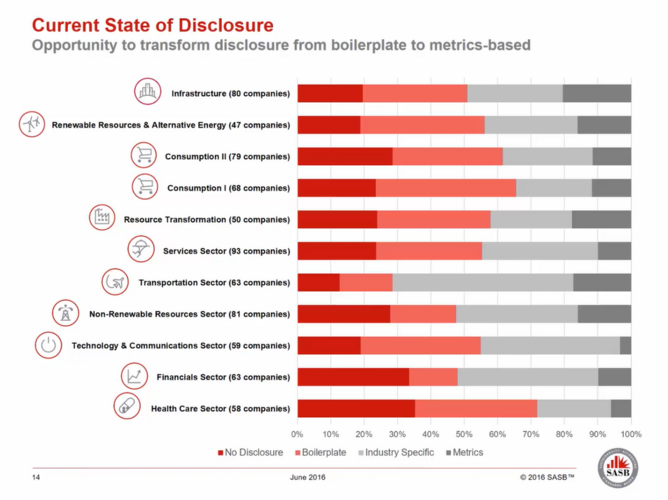

The framework aims to move away from the standardised text around ESG and focus on the metrics and disclosing relevant data to investors, allowing businesses to grow sustainably as they would financially.

To find out more about the SASB framework and industry-specific research, click here.

- ‘Client Zero’ IBM’s Guide to Using AI for SustainabilitySustainability

- Could AI and Data Help Nestlé Make Coffee Climate Resilient?Sustainability

- Businesses are Getting Sustainability Dangerously WrongSustainability

- Why EY is Warning US & Americas Companies on SustainabilitySustainability