Why EY is Warning US & Americas Companies on Sustainability

Global consultancy firm EY has sounded an alarm after a significant drop in the number of US company directors naming ‘climate change and environmental stewardship’ as a board priority for 2024.

EY’s Americas Board Priorities 2024 surveyed more than 350 corporate board members in the Americas – including the US, Argentina, Brazil, Canada, Chile and Mexico – about the subjects that are top of their in-trays.

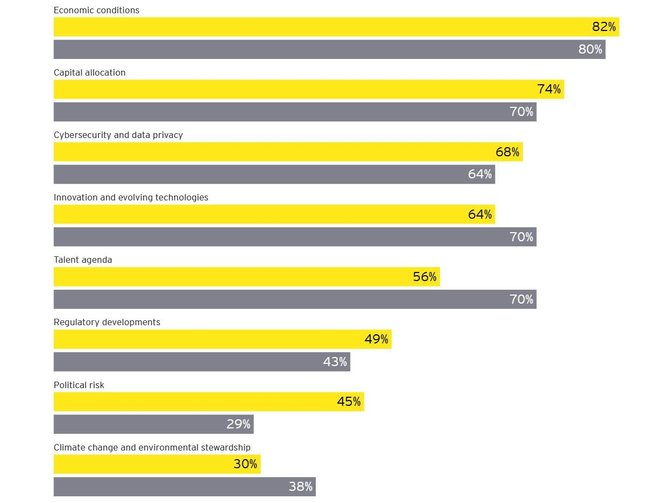

Economic conditions and capital allocation are at the top, with 82% and 74% naming them. But climate change and environmental stewardship comes in 8th on the list, with 30% – down from 38% in 2023.

‘Businesses cannot afford to be short-sighted’

Kris Pederson, EY Americas Center for Board Matters Leader, said: “Companies cannot afford to let financial caution prohibit necessary investments for long-term growth, such as those related to technology and sustainability.

“While sustainability is also material to long-term strength, leaders may be more susceptible to pausing those investments given current financial headwinds.”

Kris added: “The 2023 EY Global DNA of the CFO Survey found that while environmental, social and governance (ESG) and sustainability programs are among the top long-term investment priorities, they are also the most vulnerable to spending cuts to hit short-term earnings targets.

“Business leaders cannot afford to be short-sighted and will need to continue investing in sustainability but with an eye toward ROI and value creation.”

Regulation will present challenges

Kris sounded a warning about the increase in regulatory frameworks across the globe, meaning sustainability reporting will increasingly have to be a priority, not an extra.

She said: “Boards also need to be aware that the global sustainability reporting landscape is shifting toward regulatory mandates that will impact many companies in the Americas.”

Kris added: “There are examples like California’s (via EY US) climate disclosure laws, the European Union’s Corporate Sustainability Reporting Directive (via EY US), the International Sustainability Standards Board's first two disclosure standards and Brazil’s mandating sustainability disclosures based on those standards.

“Capital strategies require a rigorous understanding of how markets will evolve and be driven by the energy transition, what that will mean for the business strategy, and what trade-offs need to be carefully navigated.”

GenAI on the march

In contrast to climate issues, the report shows that GenAI is very much at the forefront of board members’ thoughts.

Kris said: “When it comes to GenAI, many companies are embracing the imperative to act now. One hundred percent of CEOs in the CEO survey said they are making or plan to make significant investments in GenAI, with the caveat that many remain uncertain about the direction the technology will take.

This resonates with what we heard from CFOs during a roundtable in autumn 2023. They said their companies have a number of GenAI experiments in flight but have yet to progress to defined projects with clear functional applications.”

She said a good place to start is investing in data management and governance, adding: “Companies must have a solid data foundation to enable data analytics and AI to drive future business growth and evolve the business model.”

Five priorities for boards in 2024

The report came up with five areas for boards to focus on this year:

1 - Stay agile amid continued economic uncertainty

2 - Balance discipline and transformation in capital strategy

3 - Embrace cybersecurity and data privacy as strategic advantages

4 - Guide responsible and transformative innovation and technology

5 - Enable a people-centric workforce strategy.

Kris said: “Dynamic global crises continue to challenge companies, with the escalation of conflict in the Middle East, the war in Ukraine, geopolitical complexities related to China and an uneven global economy creating a sense of permanent crisis on a multitude of fronts.

At the same time, exceptional growth opportunities seem at hand. Generative AI represents a ground-breaking leap in technology with the potential to increase productivity and transform work, business models and society.

She added: “Further, the continuing energy transition demands a reframing of business strategy to mitigate risks and thrive in a low-carbon economic future.

“In this context of crisis and opportunity, directors are deepening their engagement. They are guiding companies to build resilience by considering multiple alternative scenarios and carefully balancing discipline and transformation.”

******

Make sure you check out the latest edition of Sustainability Magazine and also sign up to our global conference series - Sustainability LIVE 2024

******

Sustainability Magazine is a BizClik brand

******