PwC CEO Survey: Sustainability Takeaways From Leading Execs

A large number of CEOs think their companies are in trouble.

More than 2,000 chief executives polled by PwC say their company won’t be “economically viable” within the next 10 years, as pressures build from climate disruption and AI.

Weighing heavily on the minds of the world’s leading executives, the climate crisis and AI are the hottest topics on the agenda at the 54th Annual Meeting of the World Economic Forum, currently taking place in Davos, Switzerland.

This year’s official theme ‘Rebuilding Trust’ reflects the WEF’s annual risk outlook, with extreme weather ranked as the top concern of Davos attendees, while misinformation and disinformation lead the list of concerns over the next two years.

PwC’s Global CEO Survey, launched on the first day of Davos, chimes with this executive sentiment – revealing that chief executives are less concerned about short-term worries like inflation and economic growth in 2024 (expectations for growth are up this year) – but are more worried about the long-term impact of climate change and AI on their business.

A higher proportion of the 4,700 CEOs surveyed this year (45% compared to 39% last year) say that in the face of climate disruption and AI, they think their company will not last a decade without reinvention.

Climate Change Pushing Corporate Reinvention

Among the mega trends pushing business leaders to transform – climate change is the most crucial and urgent.

Nearly one-third of CEOs expect climate change to transform the way create, deliver and capture value over the next three years.

As business models are reinvented, leaders are seeing climate change as an industry disruptor that bring with it opportunities as will as risks.

“As business leaders are becoming less concerned about macroeconomic challenges, they are becoming more focused on disruptive forces within their industries,” PwC Global Chairman Bob Moritz announced on LinkedIn on the first day of Davos.

“Whether it’s accelerating the roll-out of Gen AI or building the business to address the challenges and opportunities of climate transition, 2024 is a year of transformation.”

More Corporate Climate Action Required

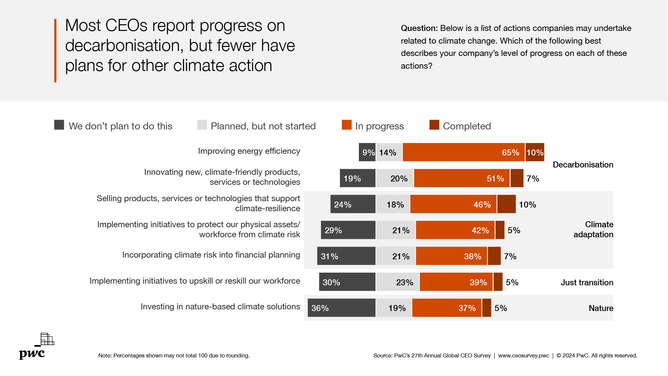

According to PwC, more climate progress is required in all corporate areas, but there are some areas more lacking, and more urgent, than others.

Unsurprisingly, the area seeing most progress is net-zero including energy efficiency, with most companies (two-thirds or 65%) moving positively forward with efforts – though just 10% report reaching their climate goals.

While around half say they are progressing in innovating on climate-friendly products or technologies.

CEOs in Western Europe are advancing at a greater pace – and are more likely to have energy efficiency and climate-focused innovation initiatives in progress or completed.

Moving beyond net-zero goals, climate action planning and progression is less positive, the report finds. Too many CEOs say they have no further plans, with fewer than half incorporating climate risk into financial planning and nearly one-third with no plans to do so.

So, what areas of climate change are CEOs failing to address – and what should they be doing to catch up?

Climate Investment: Partner With CFO on Strategy

The PwC survey reveals that for CEOs, environmental concerns are pressuring margins – with four in 10 executives accepting significantly lower rates of return on climate-friendly investments than for other investments.

CEOs in Asia-Pacific are more likely than those elsewhere to have accepted lower hurdle rates.

This is consistent with the sentiment of investors in PwC’s Global Investor Survey 2023, with two-thirds saying companies should make expenditures that address ESG issues even if doing so reduces short-term profitability.

"Return requirements are critical inputs to corporate resource allocation decisions, so evidence that CEOs are flexing their expectations as they face up to the climate challenge is a hopeful sign of potential for progress," the report states.

PwC recommends bringing the CFO on board with the strategy.

Given the CFO and finance function expertise in resource allocation, long-term capital spending, and M&A, they are the natural, trusted partners in building a more sustainable business model. They also have tools for forecasting, budgeting and risk management that can be used to “bring sustainability into the heart of the strategy”, says the report.

This should make identifying which interventions will have the most impact on decarbonisation, social sustainability, or nature a smoother task.

Prioritise Upskilling and Reskilling

Among climate actions CEOs look unlikely to take in the near future, upskilling and reskilling the workforce remains on the back-burner, the report finds.

Just 39% of executives surveyed said they were rolling out initiatives – despite upskilling widely considered as an essential part of ensuring a ‘just transition’ to a net-zero economy.

In a previous report with UNICEF, titled The Net Zero Generation, PwC makes the case for why governments and businesses “must work in partnership to prioritise and invest in green skills for youth”, says Moritz.

Mortiz points to the world’s 1.2 billion young people between the ages of 15 and 24 who are at risk of “not having the green skills they need to participate in the employment and entrepreneurial marketplace” – a risk he emphasises is especially acute for young women in low-income countries.

“We need urgent action to close these gaps by upskilling all young people … to take their place in the green economy. The road to net zero can either catalyse a fairer future for the world’s youth or leave them even farther behind.”

PwC practices what it preaches. In 2019, the firm announced investment of US$3 billion into job training for its 275,000 employees around the world.

Look for Opportunities to Create Nature-Positive Business Models

Another climate area where little action is being taken, investment in nature-based solutions is a blind spot for many corporates.

And yet investment is vital if companies are to account for the surprisingly high dependence they have on nature.

PwC estimates that 55% of global GDP, equivalent to about US$58 trillion, is moderately or highly dependent on nature.

The fast decline of natural ecosystems, and inadequate response by all societal stakeholders, makes nature loss an increasingly urgent challenge.

PwC estimates that the overall value of listings most exposed to financial risk from nature dependence on 19 major stock exchanges is nearly US$45 trillion.

The Big Four firm advises CEOs to look for possibilities to create nature-positive business models aren’t just focused on mitigating risks and boost financial returns but also benefit society.

Look for opportunities to address climate priorities and nature priorities simultaneously, like reforestation – which can help capture emissions while also enhancing biodiversity, directing capital to developing economies, and supporting indigenous peoples and local communities.