Why HSBC Says Systemic Change Needed for Net Zero Transition

Systemic change. That is a phrase you will read a lot if you digest all 101 pages of HSBC’s first Net Zero Transition Plan – released to provide clarity on the financial giant’s approach to net zero and actions it is taking to meet its 2050 goals.

That ambition – to be net zero by 2050 – was set out in October 2020, which seems a long time ago, when much of the world was still in lockdown (or between lockdowns) due to the COVID-19 pandemic.

So what’s new, and why has HSBC decided to produce this plan in 2024?

“We are present in the regions, the markets and the sectors that arguably make the biggest impact in terms of future emissions,” states HSBC Chief Sustainability Officer Celine Herweijer.

“We have an opportunity to support them to make the transition and catalyse the new economy, following the science and leveraging our entrepreneurial spirit.”

Bearing in mind HSBC has been working with industrial partners for more than 155 years, it is probably better placed than most to understand the challenges and the opportunities ahead.

What to Expect From HSBC’s Net-Zero Transition Plan

The Net Zero Transition Plan sets out three key areas that HSBC says are important milestones on the road to net zero. These are:

Vision and strategic approach – how HSBC intends to make financing, facilitation and investment choices that can have a meaningful impact on decarbonisation.

Approach to sector transitions – how to use sector pathways to engage with clients on the future of their industries and their financing needs.

Implementation plan – how to transform HSBC, to better support clients and customers and embed net zero into the business.

How Will HSBC Start its Transition to Net Zero?

Taking the first step is often the hardest part of any journey, and the road to net zero is no exception.

The task is made even more complicated when you consider HSBC works in markets and sectors that are all at different stages, moving at different speeds, and have different objectives.

It’s complex, but also provides HSBC with an opportunity to help make an impact.

Playing to its strengths, HSBC aims to deliver decarbonisation in the real world by helping industry to transform, catalysing the new economy, and decarbonising global supply chains.

This new plan covers the whole HSBC Group and highlights how individual business lines, such as HSBC Asset Management, can develop their own policies to meet their unique obligations and regulatory requirements.

Collective Action Needed From Public and Private Sectors, Says HSBC

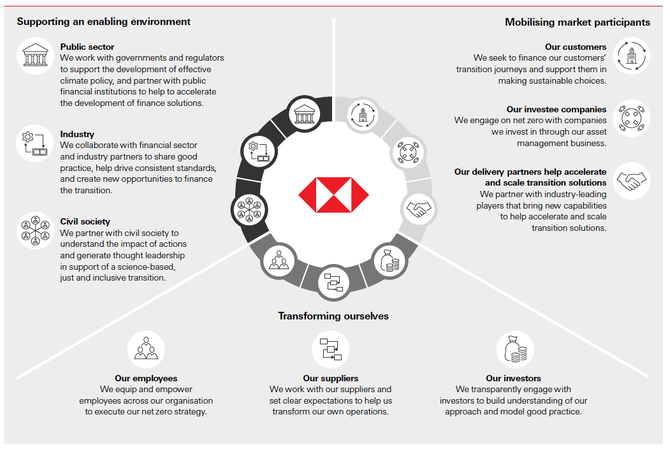

When it comes to partnering for systemic change to deliver net zero, HSBC believes it requires collective action from the private and public sectors, plus consumers, for us all to reach net zero.

HSBC will leverage its global position and power to collaborate with partners in three key ways:

- Support the development of an enabling environment for climate action and investment.

- Mobilise customers, investors, partners and the wider financial sector to help finance the transition and build inclusion and resilience.

- Transform by engaging employees, suppliers, and investors to be fit for a net zero future.

“As one of the world’s largest international banks, HSBC is well placed to help support and finance the economic transformation required to reach net zero,” says Group Chief Executive Noel Quinn.

READ the full Net Zero Transition Plan to understand why systemic change will play a significant role in that ambition.

*******************

Make sure you check out the latest edition of Sustainability Magazine and also sign up to our global conference series - Sustainability LIVE 2024.

*******************

Sustainability is a BizClik brand.

- Top 10: Women in Sustainability in the UK and EuropeSustainability

- Clean Electricity: Microsoft, Google and Nucor Join ForcesSustainability

- How Walmart is Successfully Driving Scope 3 DecarbonisationSupply Chain Sustainability

- Inside Singapore’s Ambitious Sustainable Aviation BlueprintNet Zero